The Evolving Investment Landscape for Replica Rolex in 2025

For those passionate about luxury watches or savvy investments, a pressing question arises: does a replica Rolex still hold its value as an asset in 2025? The market dynamics have shifted significantly, even from last year. Gold prices have surged dramatically, Rolex implemented another retail price increase, and the full rollout of its Certified Pre-Owned (CPO) program has altered the pre-owned market. If you own a Rolex or are considering one, understanding these drivers is crucial for navigating its investment potential.

Rolex’s enduring resale strength stems from decades of meticulous production control, marketing, and pricing. However, 2025 sees the brand transitioning beyond mere influence to actively shaping the market itself, fundamentally impacting investment value.

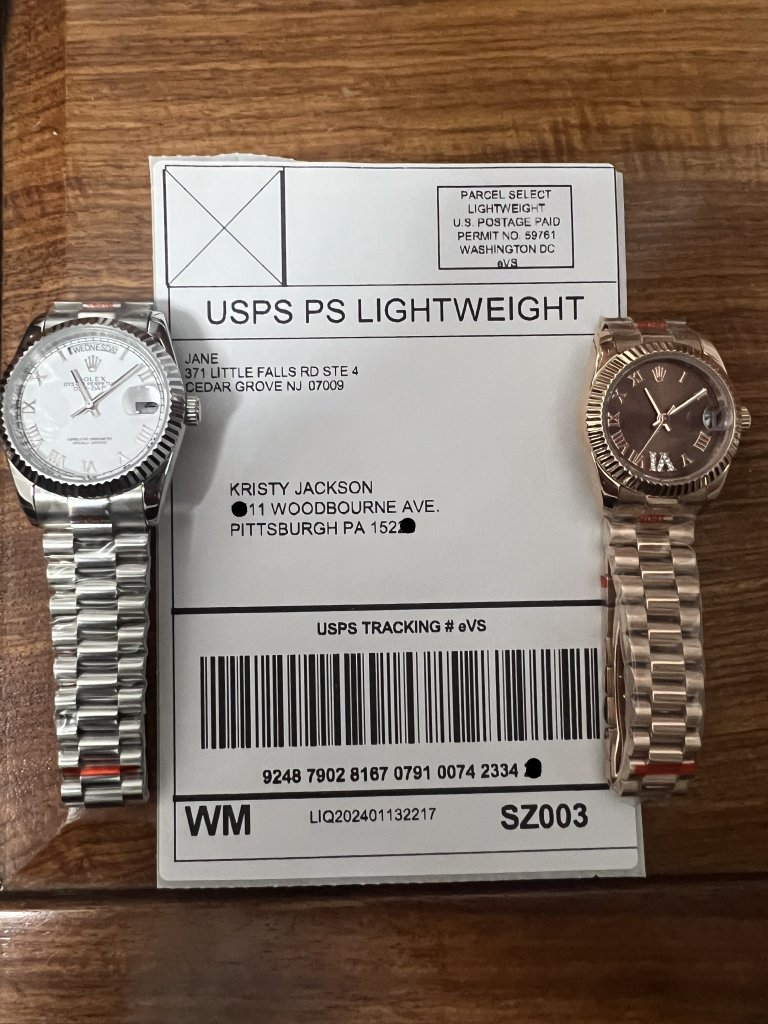

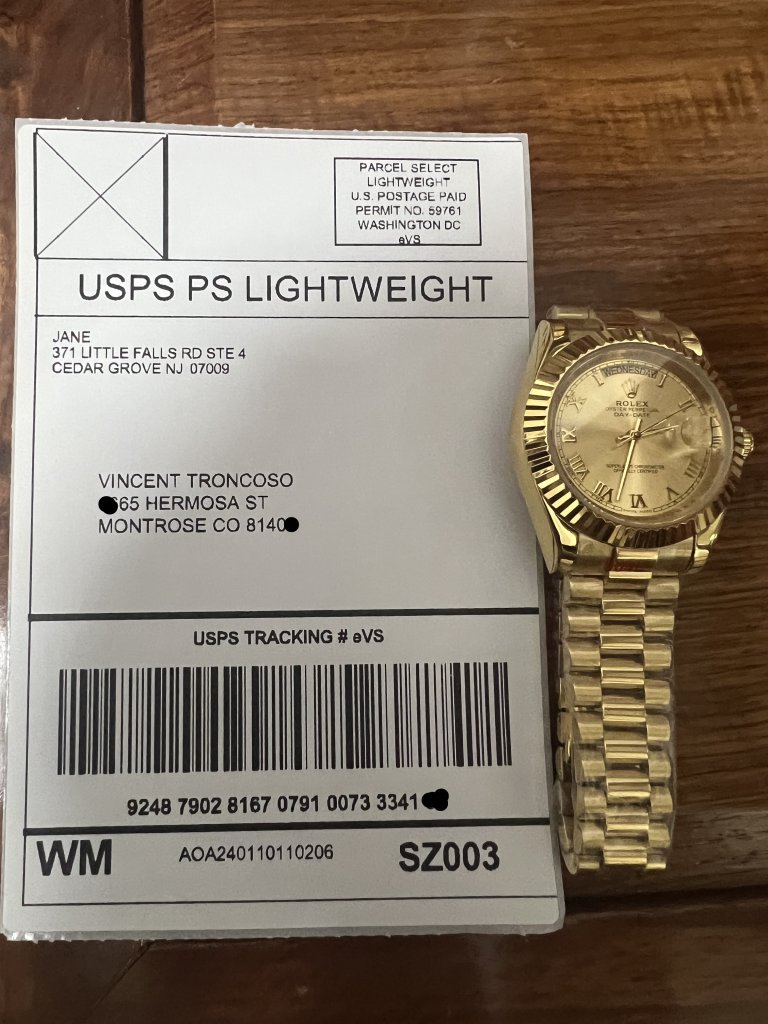

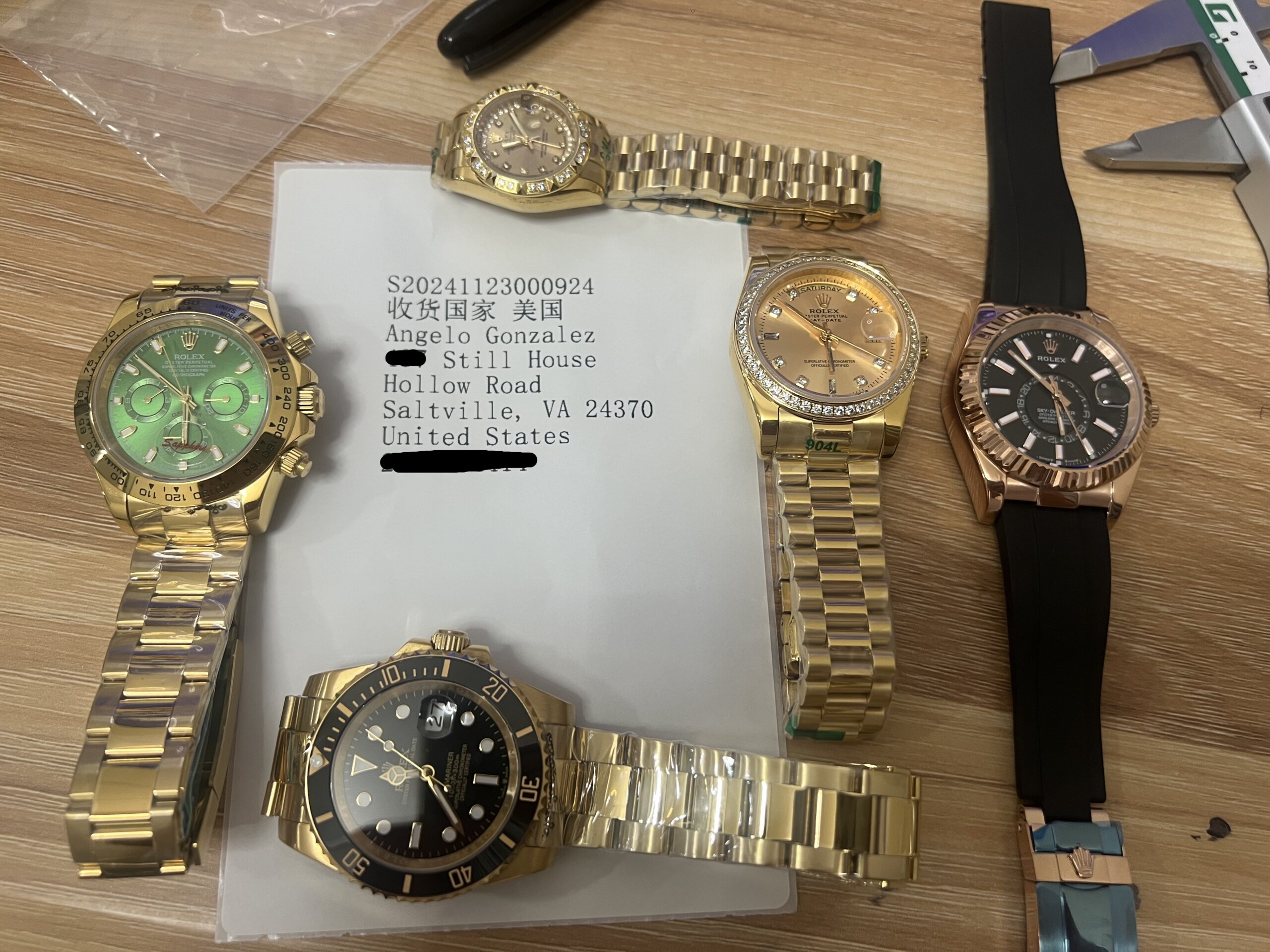

A key driver is the soaring price of gold, surpassing $2,400 per ounce early in the year – a high not seen in over a decade. This significantly impacts 18k gold models like the Rolex Day-Date, Sky-Dweller, and Yacht-Master. Rolex directly passes these rising material costs onto consumers through retail price hikes. The effect extends beyond gold: as these models become prohibitively expensive, demand shifts towards stainless steel alternatives, pushing up their prices too.

Witness the Submariner: once trading below retail on the secondary market, it now commands premiums of 5-10% above MSRP – if you can find one. This isn’t speculation; it’s pure supply, demand, and scarcity at work.

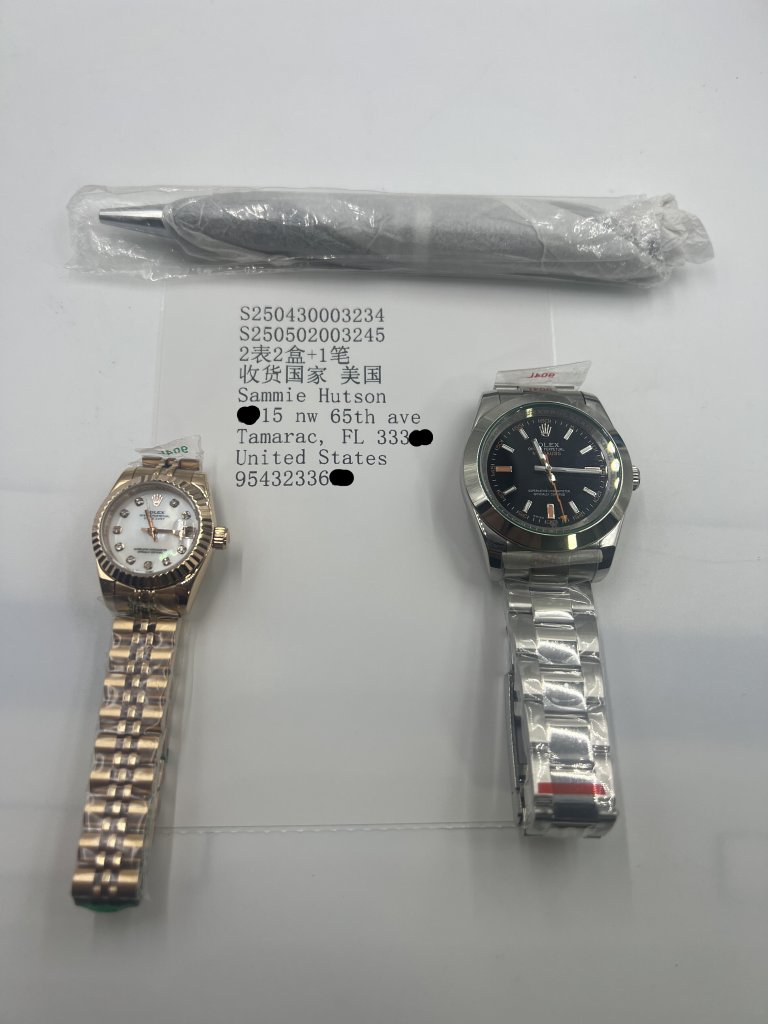

Launched in late 2022, Rolex’s Certified Pre-Owned (CPO) program is now central to its strategy. Authorized dealers now offer meticulously inspected and refurbished pre-owned models. This initiative achieves two critical goals: it grants Rolex unprecedented control over pre-owned pricing evolution, and it elevates resale expectations even for watches sold privately outside the program. Consequently, owners of well-maintained Rolexes with original box and papers benefit from this higher value ceiling, regardless of the sales channel.

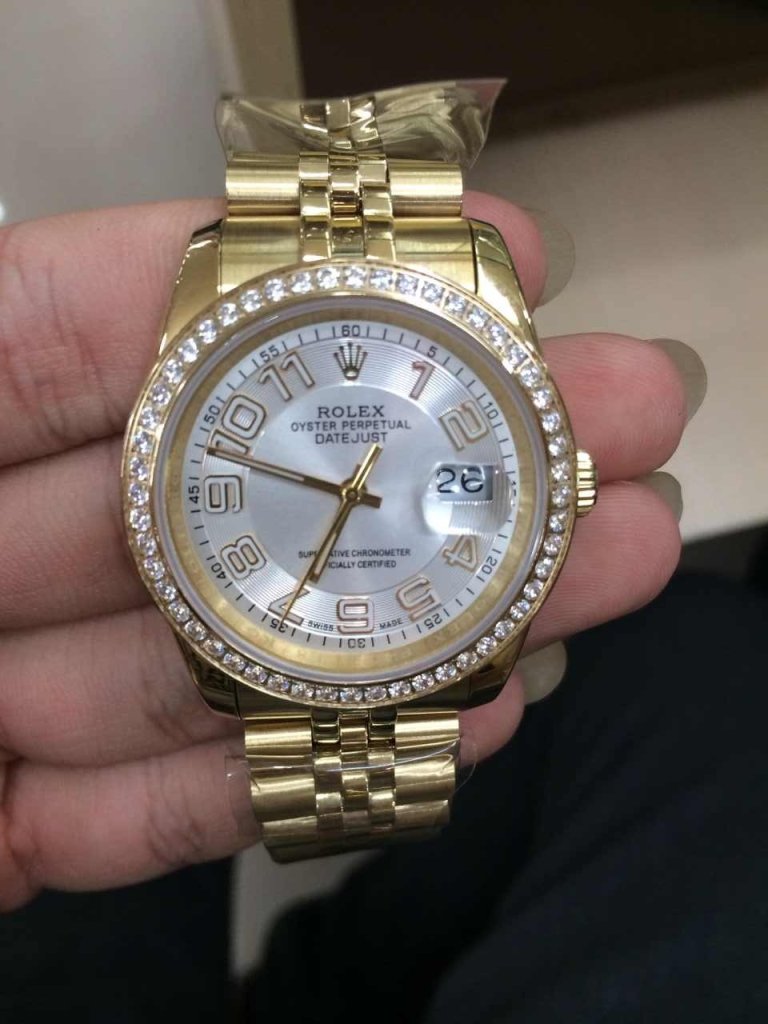

Adding further upward pressure, Rolex implemented another U.S. retail price increase in May 2025, averaging around 3%. While seemingly modest, this translates to hundreds of dollars on models like the $14,000 Daytona or $11,000 GMT-Master II. Crucially, Rolex never discounts, holds sales, or floods the market. Each price hike is permanent and lifts the entire resale structure. For example, a Datejust purchased for $8,500 in 2020, now retailing at $10,100, likely sees its resale value increase 10-20% assuming good condition and documentation.

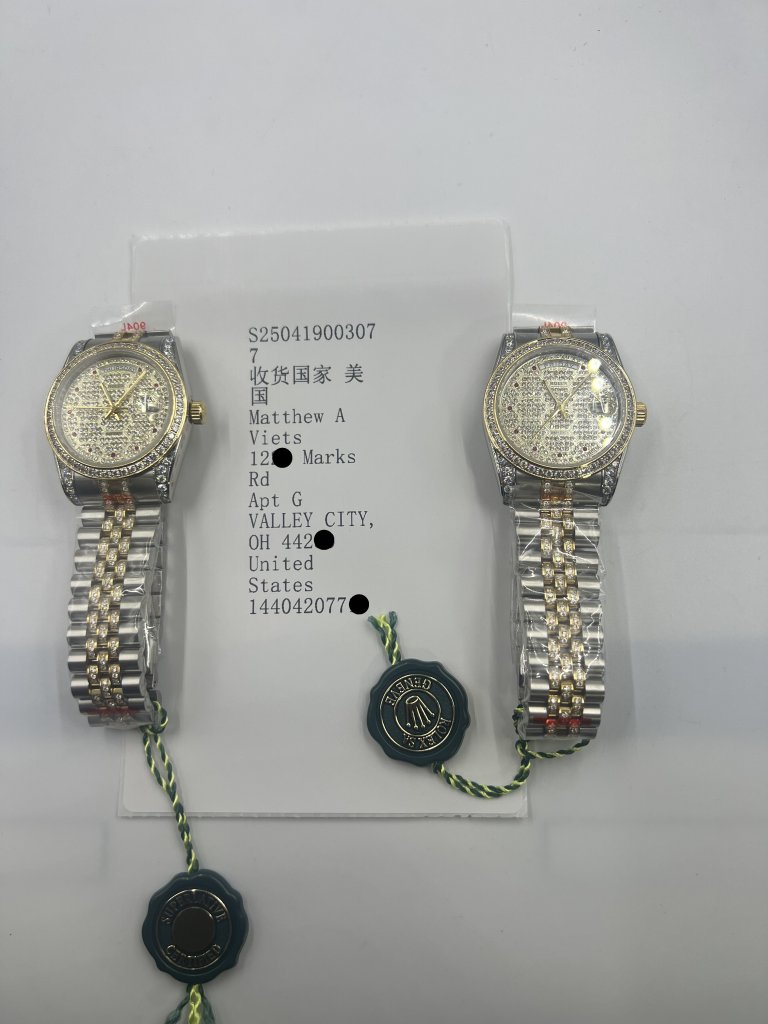

Rolex’s long-term value foundation was robust even before the 2020 watch boom. Icons like the Submariner, GMT-Master II, and Daytona appreciated steadily for over a decade, driven not just by popularity but by fake Rolex’s mastery of controlled scarcity. From 2010 to 2020, the average resale value of a stainless steel Submariner rose over 60%, fueled by consistent demand, limited production, and gradual retail increases. These models demonstrated resilience even during broader market downturns, especially “full set” examples with box, papers, and service history.

Given this landscape in 2025, holding appears the most strategic approach. The frenzy of flipping cheap replica watches has cooled post-pandemic, making quick profits harder. Trading requires deep expertise to be efficient. Simply owning the right model, however, leverages rising retail prices, the CPO program’s premium effect, and sustained demand, offering a passive path for asset appreciation. Rolex’s deliberate market control continues to shape its investment proposition, emphasizing long-term ownership over short-term speculation.

Read More »